Removal of Foreign Ownership Limit in Securities Companies

2020-03-14

China Securities Regulatory Commission ("CSRC") will further remove the foreign ownership limit in securities companies commencing on April 1, 2020. The announcement was made on March 13, 2020 by CSRC in accordance with unified policies on opening up the financial sector by China to implement the Economic and Trade Agreement Between the Government of the People's Republic of China and the Government of the United States of America ("China-US Phase One Agreement"). Qualified foreign investors may submit applications for establishing a new securities company or changing the actual controller of an existing securities company in accordance with applicable laws and regulations, relevant rules of CSRC, and relevant service guidelines. This is not only another important administrative measures for financial opening-up after the removal of foreign ownership limits in foreign-invested futures companies and fund management firms, but also the biggest leap in the gradual removal of foreign ownership limit in foreign-invested securities companies. This article comments on the removal of foreign ownership limit in securities companies based on a review of its policy history as well as our experience of establishing several foreign-invested joint venture (hereinafter "JV") securities companies.

I.Current Foreign Ownership Limit in Securities Companies

According to the current Special Administrative Measures (Negative List) for Access of Foreign Investment (2019 Edition) ("2019 Negative List"), the foreign investment ratio in a securities company shall not exceed 51%, and such limit will be removed in 2021. The foreign ownership limit in securities companies set up in the Special Administrative Measures (Negative List) for Foreign Investment Access in Pilot Free Trade Areas (2019 Edition) is also consistent with the 2019 Negative List.

According to the Supplement X to the Mainland and Hong Kong Closer Economic Partnership Arrangement and the Supplement X to the Mainland and Macao Closer Economic Partnership Arrangement (jointly "CEPA"), Hong Kong or Macao-funded financial institutions may establish one full-licensed JV securities company each in Shanghai, Guangdong Province and Shenzhen, and the maximum percentage of aggregate shareholding of the Hong Kong or Macao-funded institutions is 51%. Also, Hong Kong or Macao-funded financial institutions may establish one new full-licensed JV securities company each in certain reform experiment zones for "piloting financial reforms" as approved by Mainland China, and the percentage of aggregate shareholding of the Hong Kong or Macao-funded financial institutions in the JV should not exceed 49%.

According to the abovementioned rules and regulations, the foreign ownership in a securities company in Mainland China shall not exceed 51%.

II.History of Foreign Ownership Limit Policies in Securities Companies

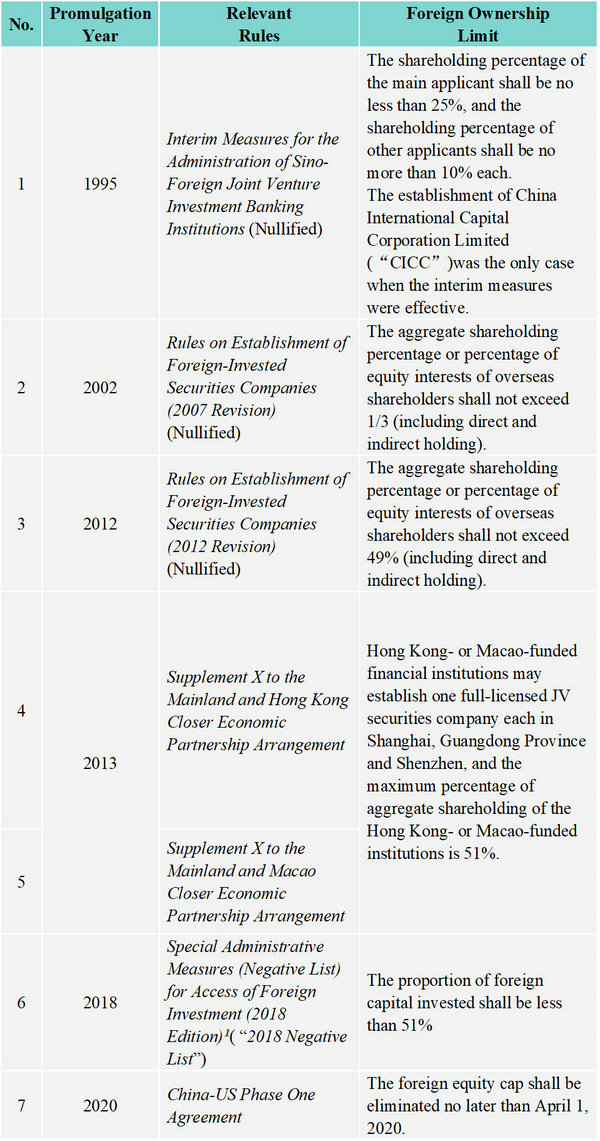

The restrictions on the foreign ownership limit in China's securities companies have been relaxed along with the opening up of the financial sector. History of relevant policies is as follows:

In 1995, the Interim Measures for the Administration of Sino-Foreign Joint Venture Investment Banking Institutions promulgated by the People's Bank of China commenced the establishment of Sino-foreign JV securities companies. The establishment of CICC was a pivotal achievement in this stage of opening up. In 2001, China joined the WTO. To fulfill its commitment to opening up the financial industry, China further expanded the access of foreign investments in China's securities sector. Following CSRC's promulgation on the Rules for the Formation of Securities Companies with Foreign Shareholders in 2002, CEFC Shanghai Securities Co., Ltd., Citi Orient Securities Co., Ltd., J.P. Morgan First Capital Securities Co., Ltd., etc. were successively established. In 2013, according to CEPA-related policies, Huajing Securities Co., Ltd., Shengang Securities Co., Ltd., HSBC Qianhai Co., Ltd., East Asia Qianhai Securities Co., Ltd., etc. were successively established.

After the promulgation of the Administrative Measures of Foreign-Invested Securities Companies in 2018, the foreign ownership limit was relaxed to no more than 51% by the 2018 Negative List. Many global investment banks entered Chinese capital market by setting up wholly owned holding securities companies or increasing its stakes in existing ventures.

In November 2018, CSRC approved UBS Group AG to increase its shareholding percentage in UBS Securities Co. Limited to 51%, and therefore UBS Group AG became the actual controller of UBS Securities Co. Limited, which was the first foreign-controlled securities company approved by CSRC after the implementation of the Administrative Measures of Foreign-Invested Securities Companies.

In March 2019, Nomura Securities Co., Ltd was approved to establish a holding securities company in Mainland China. In August 2019, Nomura Orient International Securities Co., Ltd. was formally established in China.

In March 2019, JP Morgan Chase & Co was approved to establish a holding securities company in China.

In April 2019, the application of DBS Securities for setting up a securities company in China was accepted.

In December 2019, the application of Daiwa Securities Co., Ltd. for setting up a securities company in China was accepted.

In July 2019, the Financial Stability Development Committee Under the State Council issued the Measures for Further Opening up the Financial Sector. The timeline of removing the foreign ownership limit in securities companies, fund management firms, and futures companies was brought forward from 2021 to 2020. In January 2020, China and the U.S. reached the China-US Phase One Agreement, and agreed that China shall eliminate foreign equity caps and allow wholly U.S.-owned services suppliers to participate in the securities sector.

III.Qualification Requirements for Foreign Shareholders of Securities Companies

The current qualification requirements for shareholders of securities companies are listed mainly in the Administrative Provisions on Equities of Securities Companies and the Administrative Measures on Foreign-Invested Securities Companies. The Administrative Provisions on Equities of Securities Companies mainly sets up the qualification requirements for both Chinese domestic and foreign shareholders, including the duration, integrity, equity disclosure, financial requirements, business scope, and compliance requirements (for more information, please see the authors’ Interpretation of the Administrative Provisions on Equities of Securities Companies issued on July 10, 2019).

For foreign-invested securities companies, the Administrative Measures on Foreign-Invested Securities Companies focuses more on the background information of shareholders in respect of the development of the financial business and the business strength of the securities practice (for more information, please see the authors' Review of the Administrative Measures on Foreign-Invested Securities Companies issued on May 7, 2018), which includes that the foreign shareholder shall "have good international reputation and business results; its scale of business, revenue and profits rank forefront internationally, and its long-term creditworthiness for the past three years maintain a high level", and that "the preliminary scope of business is compatible with the securities business experience of the controlling shareholder or the largest shareholder".

The above-mentioned regulations reflect the prudence of Chinese regulatory authorities on loosening the controlling rights restrictions on securities companies. By setting certain thresholds, China aimed to attract world-renowned securities institutions to its market, and discouraged ineligible foreign investors. Meanwhile, because securities practice requires professionalism, with the support of experienced world-renowned shareholders, the business of newly-established JV securities companies may get on tracks in a short period; their professional competitiveness will be boosted instantly, and their business risks will be held under control. Foreign institutions may leverage their strengths in their advantageous scopes and infuse their experience, business philosophy and brand characteristics into JV securities companies so as to provide consistent financial service experience for customers at home and abroad.

IV.Key Points to Review Foreign Shareholders of Securities Companies

To apply for establishing a securities company in China, a foreign financial institution shall prepare application documents in accordance with rules and regulations as well as relevant service guidelines promulgated by CSRC. Upon receiving the application documents, CSRC will review and make enquiries based on the information of such documents, during which CSRC usually focuses on the following issues:

1.Arrangements for Foreign Shareholders to Support the Proposed Securities Company

According to the requirements of CSRC, a proposed securities company shall be provided with follow-up business plans in the application documents, including internal management systems, internal institution settings and functions, business premises and technical systems, organizational management structures, business scope, and business development plans, etc. Shareholders of the proposed securities company shall provide their arrangements for the proposed securities company in terms of technical cooperation, personnel training, management services, marketing channels, etc. Therefore, when a foreign shareholder plans to set up a securities company in China, it shall prepare and fully explain the aforementioned information in advance.

2.Compliance of Foreign Shareholders

According to the Provisions on the Equity Management of Securities Companies, the shareholder of a securities company as well as the entities controlled by such shareholder shall have good creditability in the past three years and provide relevant legal compliance certifications. Since the foreign shareholders of securities companies are mostly large-scale institutions with a large number of controlling enterprises, in the application process, lawyers at home and abroad are required to advise the foreign institutional applicants in advance to prepare the credit certifications for relevant subjects and fully verify the certifications thereafter.

3. Illustration of Performance and Influence of Foreign Shareholders

According to the Administrative Measures on Foreign-Invested Securities Companies, the foreign shareholder shall “enjoy a good global reputation and have satisfying business performance; and its business scale, income and profits have remained top in the world in the past three years, with its long-term credit standing maintained at a high level in the last three years”. A foreign shareholder is required to illustrate the aforementioned information in detail, including providing its performance rankings, awards and other documents issued by authoritative institutions to prove the satisfactory of the relevant regulatory requirements.

4. Selection of Chinese Domestic Non-Financial Enterprise Shareholders of the JV Securities Company

As foreign institutions are relatively unfamiliar with Chinese domestic capital market, they may choose Chinese domestic companies as their JV partners. According to the Guiding Opinions on Strengthening the Supervision over Non-Financial Enterprises' Investment in Financial Institutions jointly promulgated by the People's Bank of China, China Banking and Insurance Regulatory Commission and CSRC in April 2018, the strength requirements for the non-financial enterprises of securities companies are high. Therefore, when choosing Chinese domestic non-financial enterprise partners, the foreign shareholders are required to pay full attention to and carefully verify whether their Chinese domestic partners meet such strength requirements.

V.Conclusion

With more than 30 years of development, Mainland China’s capital market has become more and more mature, and the financial services industry has served as a pivotal boost for China's economic growth. Subsequently, the development of the securities sector steps into a new stage that focuses on improving quality and efficiency. Nowadays, Chinese domestic securities companies are facing fierce homogeneous competitions despite their rising incomes. Despite the fact that the anti-risk capabilities are enhanced and compliance systems are updated in most Chinese domestic securities companies, the professional qualities of some Chinese domestic securities companies and practitioners fail to meet the ever-enhancing compliance in the context of the increasingly complex financial situation, which alarmingly gave rise to associated risk events. In the full picture, the further liberalization of China's securities sector will attract high-quality foreign financial institutions to Chinese domestic securities sector and generate "catfish effects". The high-quality foreign financial institutions may leverage their strengths in specialty and management to promote the business capabilities and service of the securities sector, and consequently stimulate the vitality of Chinese capital market and elevate the service standard of the whole financial sector. Moreover, the potential of China's economy will accrue the everlasting momentum to the development of Chinese domestic capital market and provide a broader market for foreign financial institutions.

DeHeng Law Offices, as a large law firm deeply rooted in capital market legal services, has provided high-quality and efficient legal services for the establishment of a number of foreign-invested securities companies for a long time. DeHeng is committed to promoting the healthy and compliant development of the capital market. We will follow up on the relevant developments of foreign-invested securities companies and update professional legal interpretations in time.

Intern Hao Boyang (Shanghai University of Finance and Economics) also contributed to this article.

Notes:

[1]Administrative Measures of Foreign-Invested Securities Companies, effective in April 2018, does not explicit a foreign ownership limit.

Authors:

FANG Li

Assistant Associate

Supervisor:

SHEN Hongshan

Partner/Associate

WANG Yuwei

Partner/Associate

This article was written by the lawyer of DeHeng Law Offices. It represents only the opinions of the authors and should not in any way be considered as formal legal opinions or advice given by DeHeng Law Offices or its lawyers. If any part of these articles is reproduced or quoted, please indicate the source.

声明:

本文由德恒律师事务所律师原创,仅代表作者本人观点,不得视为德恒律师事务所或其律师出具的正式法律意见或建议。如需转载或引用本文的任何内容,请注明出处。